26 Feb Your Guide to Retirement Planning

Unfortunately, planning for retirement isn’t as simple as it once was.

There is no universal route to financial security in retirement. However, there are a few optional steps you can take to ensure you’re feeling confident and secure through your future transition. Here are a few questions that will get your retirement planning underway and if it happens to lead you to more questions, that’s okay! It’s better to have them now when you can plan accordingly.

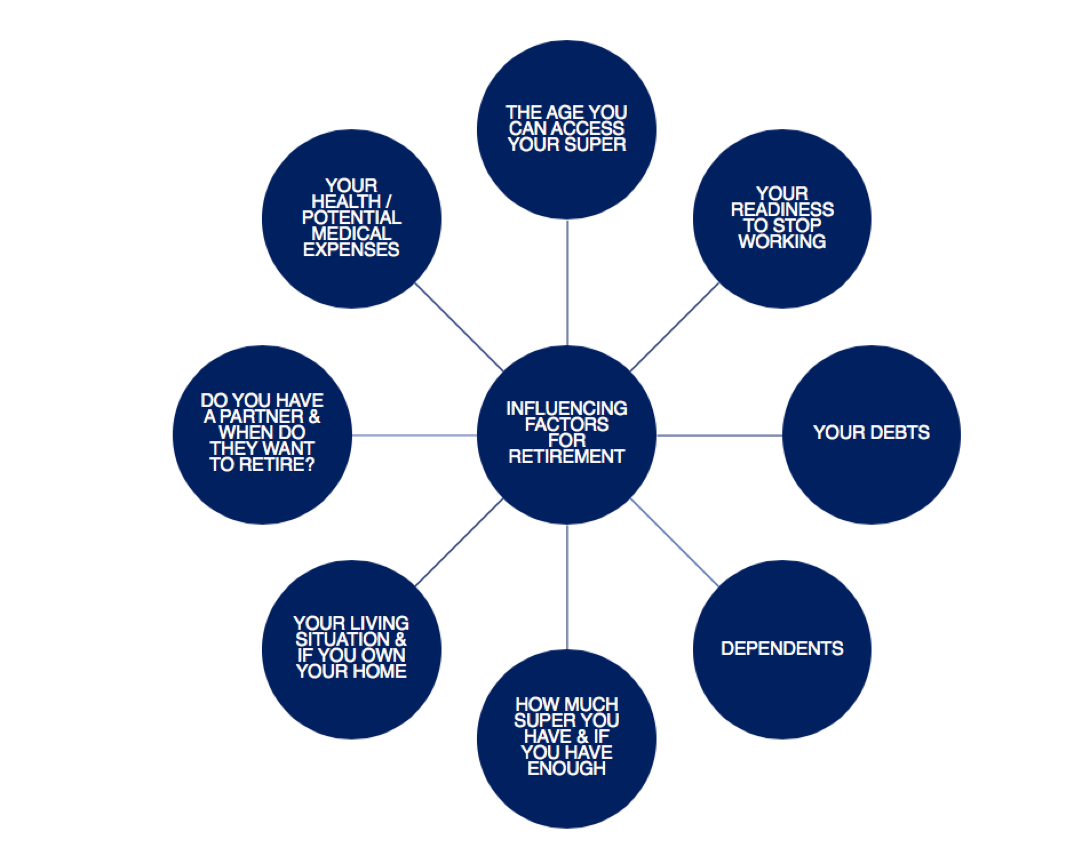

1. When would you like to retire?

This is a question we like to ask our clients when planning their finances for retirement. It’s a great first step towards giving yourself a timeline in which you can realistically achieve the right amount of savings. This is all dependant on the lifestyle you would like to live through retirement as well as your current income. Deciding when you would like to retire is a big decision. The below chart shows a few varying factors that may influence when you retire.

2. How do you plan to obtain money for your retirement?

Super Contributions

Every employer within Australia is obliged to pay 9.5% of their employee’s wage towards their Superannuation. This is regardless as to whether the employee is full time, part time or casual. Depending on your current income and super contributions, you may not be in a position that supports your ideal retirement plan and goals.

Other options that may help you source funds for your retirement may include:

- Making additional super contributions

- Reducing your investment expenses and fees (downsizing your home)

- Salary Sacrifice

- Finding lost super

- Qualification for the age pension

3. How much super are you planning to have?

Lack of planning and engagement is likely to contribute to less-than-optimum superannuation in retirement. It’s important for you to decide on the kind of lifestyle you are looking for, to ensure you’re on track for a comfortable retirement. It’s estimated that the average “comfortable” retirement lifestyle requires an individual to have superannuation savings around $545,000 or $640,000 for a couple (according to the Association of Super Funds). Whilst this figure is a rough estimation, everyone’s perception of a comfortable lifestyle varies.

4. Close to retirement and low on money?

Running out of money is a frightening thought for everyone, especially through retirement. If you happen to need an extra boost in your super beforehand, here are a few ways you can potentially top it up.

- Review your Budget: Firstly, you should look at what you deem as living a comfortable lifestyle and cut back accordingly to your needs.

- Delay Retirement: Secondly, you could delay your retirement to give yourself more time to add to it. A great benefit from this is that after the age of 60, you can withdraw your super tax-free!

- Review your Investments: Thirdly, you could reflect on your investment strategy and portfolio to review any changes that you could benefit.

- Alternative Retirement Funds: Lastly, as mentioned in our list earlier, options for boosting your superfund could be downsizing your home, making salary sacrifices or potentially finding lost super.

Feel free to chat to the team at Conrad Carlile who can help you calculate whether your current contributions are keeping you on track.

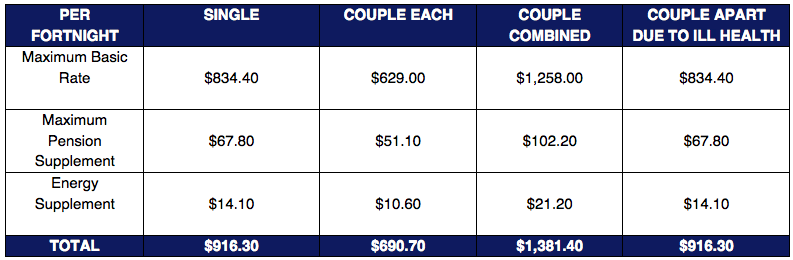

5. Living off the Age Pension

It is important to be aware of the different rates available for individuals and couples living on the age pension. However, the age pension often doesn’t support or fund the ‘comfortable’ lifestyle that most people would prefer. View the current ‘normal’ rates available for retirees in Australia in the table below.

(Source: Australian Department of Human Resources)

6. Stay on top of your goals!

We can’t stress how important it is to stay on top of your goals. This is to ensure you’re on the right track for living the life you want through retirement. Taking an active role in your retirement plan will offer you security in the future, whilst actively increasing your savings. We believe the basics of planning your retirement is apart of the crucial financial decisions you make in your life.

Planning for the life that you deserve is important to us. So, feel free to contact us if you need help developing and implementing an effective retirement strategy. If you’re short for time, you can fill out our quick and easy online form, and one of our professional advisors will be in touch!