03 Dec Australia’s Corporate Tax Reduction

The Australian Parliament has recently passed new legislation to fast-track the reduction of corporate taxes from 27.5% to 25% within the next five years. The new ‘Treasury Laws Amendment Bill 2018″ is estimated to provide tax relief for around 3.3 million small to medium-sized businesses. It is expected that an estimated seven million Australians will be employed under the new bill, resulting in bigger investments, higher wages and more jobs.

What is the Full Corporate Tax Rate?

The full corporate tax rate under Australian legislation is 30%. This percentage only applies to businesses who aren’t eligible for lower tax rates of 27.5%. When a business is eligible for a lower tax rate, this is called either a Small Business Entity or a Base Rate Entity. Over the years, the eligibility and definition for who can apply for lower tax rates have changed, resulting in the different titles.

Small Business Entities

Small Business Entities apply to businesses within the income year of 2016/2017 who are eligible for a lower corporate tax rate of 27.5%. To be eligible, businesses within this financial year must have:

- an aggregated turnover less than $10 million

- been running a business for part or all of the year

Base Rate Entities

Base Rate Entities apply to businesses within the income year of 2017/2018 who are eligible for a lower tax rate of 27.5%. To be eligible, businesses within this financial year must have:

- An aggregated turnover of less than $25 million

- No more than 80% of the income is to be derived from a passive nature

What is included in Passive Income?

- Interest Income (some exceptions apply)

- Royalties and Rent (irrespective of whether it is commercial or residential)

- Dividends (from entities where you own less than 10% of shares)

- Net capital gain

- Gains on qualifying securities

- Partnership income (to the extent that it’s traceable directly or indirectly)

- Trust income (to the extent that it’s traceable directly or indirectly)

What has changed with the New Legislation?

Firstly, the new Bill has loosened the eligibility for becoming a Base Rate Entity. The new law increases the aggregated turnover, thus allowing for more companies to have access to the lower corporate tax rates in the 2018/2019 financial year.

The criteria for base rate entities have changed to:

- An aggregate turnover of less than $50 million

- No more than 80% of the income is to be derived from a passive nature

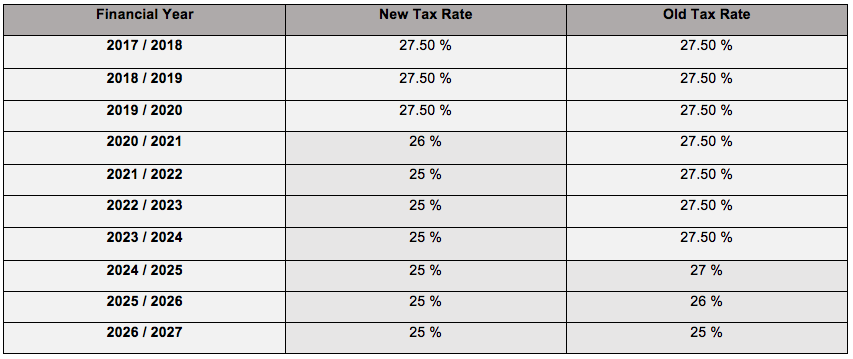

Secondly, the new legislation has fast-tracked the lower corporate tax rates to be available in 2020 in comparison to 2024.

To view the full report on the new ‘Treasury Laws Amendment Bill 2018″ click here. We highly advise that all businesses seek financial advice from a professional regarding how these Corporate Tax Changes may impact your business in the financial years moving forward. Feel free to contact the team at Conrad Carlile or send an online enquiry regarding any business or financial queries you may have. Our team is always happy to help!